In this curated reflection, Urban Missiology highlights a recent report exposing how financial scams continue to exploit one of society's most vulnerable groups — our elders. As the Church and community advocates, understanding these schemes equips us to protect, educate, and empower those we serve.

Source: Clark.com Staff | October 22, 2025

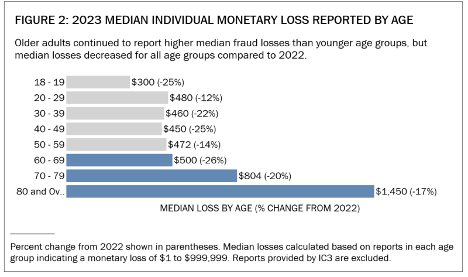

One of the most vulnerable populations in America – our seniors – are being taken advantage of by scammers. The Federal Trade Commission (FTC) reports that seniors lost an estimated $1.9 billion to fraud in 2023 alone, a figure that represents only a fraction of the total harm caused by unreported cases.

Below are the ten most common scams impacting older adults, according to the Protecting Older Consumers 2023–2024 report and advice from money expert Clark Howard and Team Clark.

1. Investment Scams — $538 Million Lost

Many seniors seeking to grow their retirement funds fall prey to fake investment offers. Losses in this category rose 34% year-over-year. The U.S. Securities and Exchange Commission advises verifying any investment professional's disciplinary record before committing funds.

2. Business Impostor Scams — $311 Million Lost

Fraudsters often impersonate corporate executives or payroll staff to obtain personal information, which they later use for identity theft or tax fraud. Always verify the sender's identity before sharing sensitive data by phone or email.

3. Romance Scams — $277 Million Lost

These "loneliness scams" exploit emotional vulnerability, convincing victims to send money for fabricated emergencies or travel expenses. As Clark Howard's team warns: if love suddenly comes with a price tag, it's a scam.

4. Government Impostor Scams — $254 Million Lost

Criminals pretending to be government agents use fear to extract personal details or money. Clark advises a simple rule: "If I don't know the number, I don't answer the call." Never click suspicious links in texts or emails.

5. Tech Support Scams — $175 Million Lost

These scammers call claiming to be from Microsoft or Apple, requesting remote access to "fix" a non-existent issue. This allows them to install malware and steal financial data. Never give strangers access to your computer.

6. Prize, Sweepstakes, and Lottery Scams — $128 Million Lost

While reports of these scams slightly declined, they remain pervasive. Any request for upfront payment to collect winnings is fraudulent. The FTC reminds consumers: "If they say you've won and then ask you to pay, it's a scam."

7. Online Shopping Scams — $62 Million Lost

Fake websites can mirror real ones to steal payment details. Use verification tools like Google's Transparency Report to confirm site authenticity before purchasing.

8. Fake Check Scams — $59 Million Lost

Scammers send counterfeit checks, often for more than owed, and instruct victims to send the difference. When the check bounces, the victim loses both money and credibility. Never accept overpayment from unknown sources.

9. Family and Friend Impostor Scams — $36 Million Lost

Fraudsters pose as loved ones in distress, often claiming they've been kidnapped or need urgent help. Resist the urge to respond emotionally—verify through other channels before taking action.

10. Travel Scams — $22 Million Lost

From fake airline tickets to fraudulent hotel listings, these scams target retirees eager to explore. Clark Howard recommends booking directly with airlines or reputable agents, and researching unfamiliar travel sites before paying.

As advocates for justice and dignity, faith communities play a vital role in educating elders about digital safety. Churches, ministries, and nonprofits can host workshops, offer resource guides, or partner with local law enforcement to promote awareness and prevention.

For additional guidance: Visit consumer.ftc.gov or contact the FTC's Consumer Response Center at 1-877-FTC-HELP.

Read the original report on Clark.com.

What are the most common scams targeting seniors?

The top scams include investment, business impostor, romance, and tech support fraud, all responsible for hundreds of millions in losses annually:contentReference[oaicite:0].

How can older adults protect themselves from scams?

They can protect themselves by avoiding unknown callers, verifying investment sources, never sharing personal information online, and reporting suspected fraud to the FTC:contentReference[oaicite:1].

news via inbox

Don’t miss a moment—subscribe now and be the first to know when new stories drop.